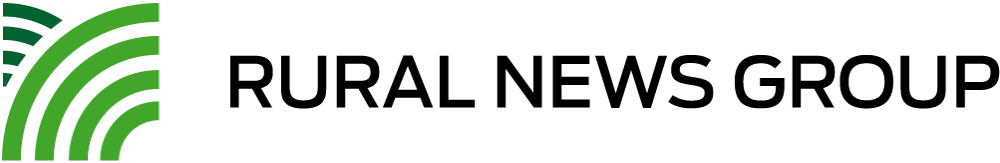

Lamb kill rates are on the up in both islands. North Island plants are also over booked due to the dry conditions. Lamb kill rates are running at levels 37% higher than the 5 year average for this time of year. There are also plenty of ewes backed up with the dry conditions and companies are starting to switch their attention back on ewes to start to clear the backlog there. Prices will ease further with some companies indicating that schedules will be back to $4.50/kg (gross) in the not too distant future. Meat company margins on lamb remain around 15-20% lower than 5 year average levels. This suggests current farmgate prices remain slightly over-cooked relative to overseas market prices.

UK lamb production on the up

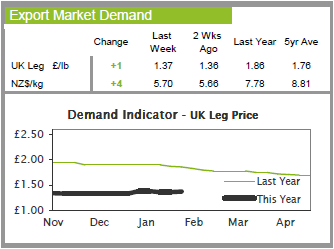

NZ lamb exporters are likely to be facing more competition in the UK market once Easter chilled orders cease with the expectation domestic supplies will be well above normal in the months to come. A recently released report from EBLEX has revealed 500,000 fewer UK lambs were slaughtered in the second half of 2012 as the poor season made finishing difficult. Provided ewe lamb retentions remain static, this means carryover numbers could be as high as 750,000 head and with confidence in the sheep industry waning, retention could well be lower which will push further lambs to slaughter. Higher numbers will be offset slightly by lower overall carcass weights however it is expected that lamb production will be higher by some margin in the first six months of 2013. NZ exporters will need to prepare for some competition on price.

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283.

|